By Katherine Handcock, A Mighty Girl Senior Research Intern

Welcome to the second part of our discussion about teaching money management skills to kids! If your child is a pre-teen or teenager, money is likely becoming an increasingly important aspect of their lives: the things they want cost more, they are able to start taking on age-appropriate work for pay, and independent adult spending is not many years away. In this article, we’ll present some resources for preparing your pre-teen or teenager for living a financially savvy adult life. For resources for younger children, check out part one in our series: Teaching Money Skills (Preschool and Elementary).

Practicing Money Skills

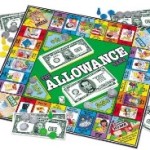

Board games and other money-related games can still help teach the complexity of money to pre-teen kids; you just need to make sure that the games you select include components other than simple money recognition. The Allowance Game, while suitable for a child as young as 5, still has plenty to teach to kids as old as 11 as well. The game features several ways to earn money, and lots of ways to spend it, but kids must keep in mind that the winner is the first person to collect $20. Choosing whether to buy or save, with a final goal in mind, is a great way for kids to practice money management in a risk-free way.

Board games and other money-related games can still help teach the complexity of money to pre-teen kids; you just need to make sure that the games you select include components other than simple money recognition. The Allowance Game, while suitable for a child as young as 5, still has plenty to teach to kids as old as 11 as well. The game features several ways to earn money, and lots of ways to spend it, but kids must keep in mind that the winner is the first person to collect $20. Choosing whether to buy or save, with a final goal in mind, is a great way for kids to practice money management in a risk-free way.

Earning Money for a Goal

There are also lots of great stories about earning and saving money for girls this age. Two that stand out in A Mighty Girl’s collection are How Ella Grew an Electric Guitar by Orly Sade and Ellen Neuborne and Rickshaw Girl by Mitali Perkins.  In How Ella Grew an Electric Guitar, recommended for readers 9 to 13, an ambitious 11-year-old needs an electric guitar for the band she and her friends have formed. Ella’s parents, however, won’t buy one; instead, they offer to teach Ella and her friends how they could make the money to buy one themselves. This book shows pre-teens how business skills apply in the real world, and how it is possible for them to earn money independently. The book’s authors are, respectively, a professor of finance and former editor at Business Week who wrote the book to help teach children basic financial concepts.

In How Ella Grew an Electric Guitar, recommended for readers 9 to 13, an ambitious 11-year-old needs an electric guitar for the band she and her friends have formed. Ella’s parents, however, won’t buy one; instead, they offer to teach Ella and her friends how they could make the money to buy one themselves. This book shows pre-teens how business skills apply in the real world, and how it is possible for them to earn money independently. The book’s authors are, respectively, a professor of finance and former editor at Business Week who wrote the book to help teach children basic financial concepts.

Rickshaw Girl, which is set in Bangladesh, provides a window into life and money for girls in a very different culture. Naima, who wants to help support her struggling family, feels unable to contribute because of her gender. Disguising herself as a boy so that she can earn money driving her father’s rickshaw only makes things worse: she crashes it and adds to her family’s debt. However, Naima’s talent at painting alpacas, traditional designs women use to decorate their homes on special occasions, opens a new opportunity for contributing to her family’s success. Naima’s story, recommended for readers 7 to 10, will inspire girls to investigate their own talents, but it will also remind them how fortunate they are to have the opportunities they do.

Managing Real Money

Most kids this age will have regular access to money, from allowances or earned money (from extra chores, babysitting, and, in the mid- to late-teen years, their first salaried job). Dividing money into categories (including spending, saving, donating, and investing) is an money management technique is effective for all ages. The Money-Savvy Pig mentioned in our first article is still a great tool, but tweens and teens may feel that they want a more adult solution.

Most kids this age will have regular access to money, from allowances or earned money (from extra chores, babysitting, and, in the mid- to late-teen years, their first salaried job). Dividing money into categories (including spending, saving, donating, and investing) is an money management technique is effective for all ages. The Money-Savvy Pig mentioned in our first article is still a great tool, but tweens and teens may feel that they want a more adult solution.

One option is the Moonjar Classic Moneybox, which has three color-coded moneyboxes for spending, saving, and sharing. This divided bank may be more in keeping with an older girl’s aesthetic, although it omits the “investing” category. Alternately, kids this age are ready to learn to use a bank account, so you could set up one checking account for day-to-day spending, one savings account, and one investment account (either in addition to savings or included as part of it) to accomplish the same goals as a divided bank would at home.

At some point in their teens, your kids should start handling their money with increasing independence, but that doesn’t mean you can’t provide them with resources to help. Two great books are It’s A Money Thing!: A Girl's Guide to Managing Money by the Women's Foundation of California and The Smart Girl’s Guide to Money by Nancy Holyoke.

At some point in their teens, your kids should start handling their money with increasing independence, but that doesn’t mean you can’t provide them with resources to help. Two great books are It’s A Money Thing!: A Girl's Guide to Managing Money by the Women's Foundation of California and The Smart Girl’s Guide to Money by Nancy Holyoke.

It’s A Money Thing!: A Girl's Guide to Managing Money, recommended for ages 12 and up, covers critical skills like how to budget, how to read a paycheck, and understanding stocks and investing. The spiral bound guide also features journal pages, fill-in-the-blanks lists and charts to engage girls directly in learning money management skills.

The Smart Girl’s Guide to Money, recommended for girls 9 to 14, is part of American Girl’s Smart Girl’s Guide series and also includes some discussions of the emotional aspects of money: how it affects relationships, how to determine your money spending style, and understanding needs and wants. Additionally, it will help girls determine if they would enjoy starting a business, and finishes with a list of 101 money-making ideas. Both are great, entertaining, and informative reads to help launch your Mighty Girl into independent financial life.

Tips for Teaching Money Management

A few final tips for teaching pre-teens and teens about money:

- Involve pre-teens and teens in discussions about how money will be spent on their “extras”. Which does she want more: the $350 of fees for her next season of sports, or an iPad? Is she willing to find a phone contract that costs $25 per month less so that she has an extra $150 in spending money for your vacation in a year?

- Allow your kids to practice borrowing by allowing them advances on their allowance -- with interest. Show them how much more money their purchase costs if they borrow by calculating their interest costs over various payment periods. They can pay in monthly installments or outright, but if they default, “garnish” their allowance by refusing to give it to them until their “balance” is paid.

- Consider adding a clothing fund to your child’s allowance, either monthly or in a lump sum at the beginning of a season. Put restrictions on it at first (for example, you might say they have to buy at least six shirts, three pairs of pants, two sweaters, and a nice outfit for special occasions.) Later, allow free spending, and let them learn the consequences of their decisions -- if she only buys two shirts, she’s going to be doing a lot of laundry!

- Let your kids make money mistakes, and don’t bail them out! If she has no money for the dance, let her borrow against her allowance or earn it instead. Right now her mistake will cost her a few dollars in interest owed to you, but she’s only a few years away from being able to max out four student credit cards. Learning from her mistakes now will give her the confidence to handle money well in the future, and that’s a much more important gift than a $10 dance ticket!

Recommended Resources

- For more books for children and teens about money management, visit our Money / Entrepreneurship section.

- For more toys and game for teaching money management, visit our Money Management section in Life Skills toys.

- For money management resources for younger children, check out part one in our series Teaching Money Skills (Preschool and Elementary).