New data finds parents pay girls half the allowance paid to boys.

The gender pay gap starts much earlier than most people imagine with new data showing that parents, on average, pay boys twice as much for doing chores per week than girls. The chore app BusyKid analyzed 10,000 families in their database and discovered that the average boy earned $13.80 in weekly allowance, while the average girl received only $6.71. The results highlight how traditional 'girls' work' is viewed by parents as being less valuable than that often assigned to boys — and raise awareness of the concerning messages girls receive from an early age about what their work is worth. "It was interesting and shocking to see how much of a difference in pay there was between boys and girls in our network," says BusyKid CEO Gregg Murset. "I think this is an important wake-up call for parents to be cognizant of what they are paying to make sure they are being as fair as possible. I don't think any parent would intentionally pay differently based on gender, but clearly, it's happening."

Murset suspects that a significant part of this early gender pay gap comes from the division of jobs into "girls' work" and "boys' work," which academics call occupational segregation. "There's a difference when it comes to the types of chores that boys and girls typically do," he points out. "Let's say cleaning the bathroom versus mowing the lawn." The pay difference highlights how society traditionally undervalues work that is deemed "women's work." Though such undervaluing only explains part of the difference in pay since researchers have also found that even when girls and boys did the same job, such as babysitting, male babysitters still earned more than female ones. Since parents consider girls to be natural caregivers, they are not viewed as providing as valuable a service as male sitters who are seen as "older brother figures."

Socialization also plays an important role in girls not asking for what they're worth. Yasemin Besen-Cassino, sociology professor at Montclair State University and author of The Cost of Being a Girl, has found that, unlike male babysitters, female babysitters, for example, were more likely to be asked to do other chores like cleaning, dishes, or helping with homework. Many of the girls she interviewed knew they should ask for more money but were already worried about offending the family or losing the job. "We put this extra pressure on girls, especially the ones who do care work, that money is in opposition to care," she explains. "The minute something is monetized for women, it's seen as not loving and caring and being a team player."

If parents recognize these biases at play, however, they can confront them directly — and in the process, start important conversations about money with their daughters. "This is a really great opportunity for parents to start thinking about what they're doing and what message they're sending," Murset asserts. "This is a perfect conversation starter for parents who might be looking for ways to discuss their whole financial world with their kids — especially girls, frankly."

For books, toys, and other resources to teach kids of all ages about money management, visit our blog post, 30 Resources to Teach Kids Financial Literacy. To read the full story, visit CNN.

Recommended related Resources

A Chair for My Mother

A Chair for My Mother

Rosa's family's home was destroyed by a fire, and while neighbors are able to provide much of what they need, the one thing that's missing is a big, soft chair to relax in after a long day. So every day, Rosa, Grandma, and Mama save everything they can in a big jar: Mama contributes her tips from her job as a waitress, Grandma tosses in change when she saves money at the market, and even Rosa puts her few pennies in. Finally, when the jar is full, the family picks a rose-covered chair, just as comfortable as they've been dreaming the whole time. This beloved book celebrates both the value of work and the rewards that come from careful money management.

The Berenstain Bears' Trouble With Money

The Berenstain Bears' Trouble With Money

Sister and Brother Bear don't seem to be able to hold onto money for a second — as soon as they get it, they spend it! So Mama and Papa decide to start teaching them the value of money by getting them to earn some themselves. The cubs catch onto the idea quickly, walking pets, picking blackberries, and selling lemonade. When they go a little bit overboard, though, and start going to excessive lengths for a few extra pennies, it's time to teach the kids that what makes really important is what you can do with it... like arranging a surprise for someone special. For another book from the same series addressing money management, check out The Berenstain Bears' Dollars and Sense.

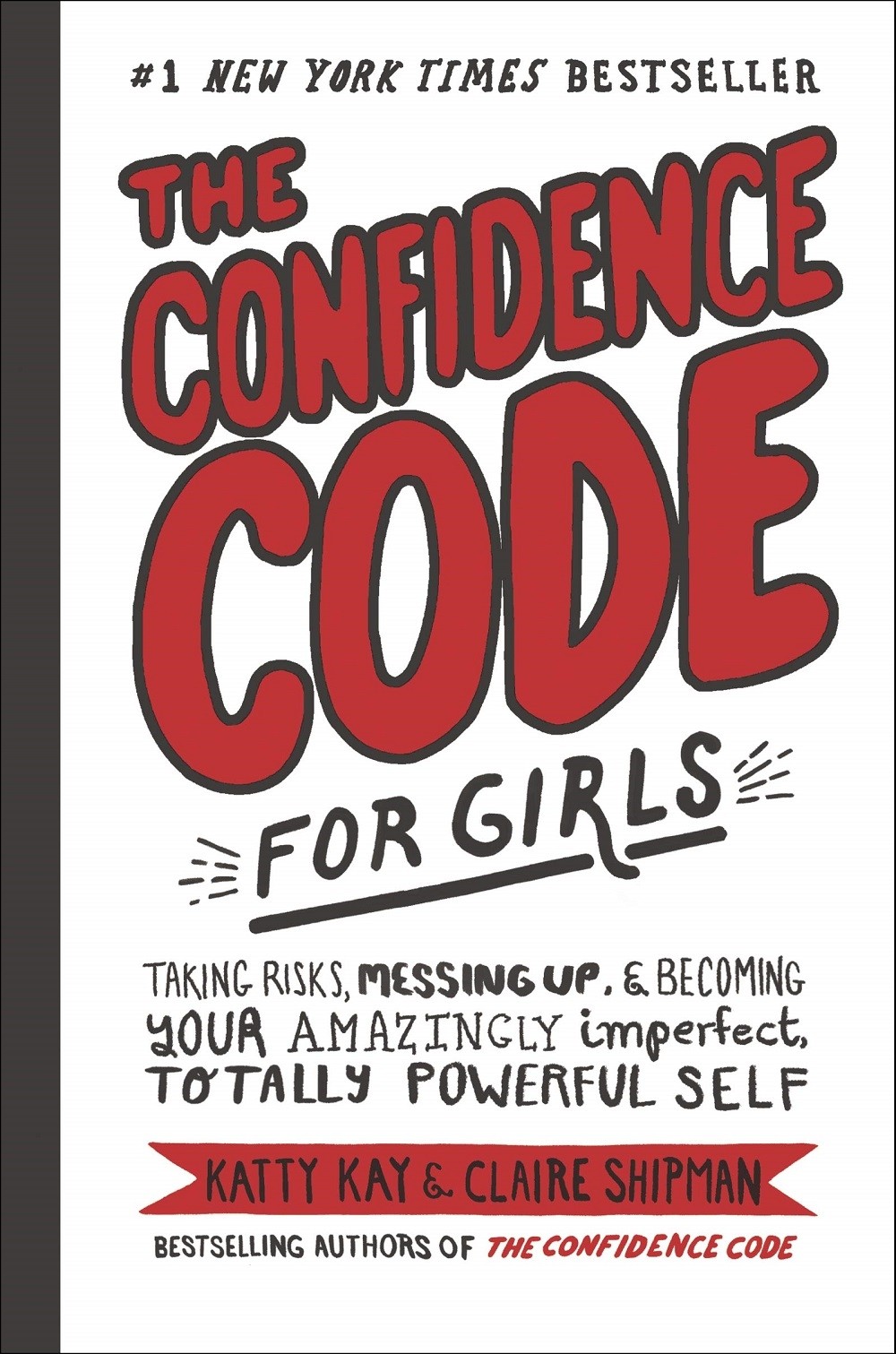

The Confidence Code for Girls

Taking Risks, Messing Up, and Becoming Your Amazingly Imperfect, Totally Powerful Self

The Confidence Code for Girls

Taking Risks, Messing Up, and Becoming Your Amazingly Imperfect, Totally Powerful Self

Many girls are consumed by self-doubt on the inside, especially during the tween and teen years — but if they can crack the confidence code, they can learn how to set worries aside and focus their energy on what's really important: confidently pursuing their dreams and embracing their authentic selves! In this book, Katty Kay and Claire Shipman, the authors of the best-selling The Confidence Code for adult women, draw on the latest research to help tweens understand how to short-circuit the thoughts that drain your confidence and hold you back. Illustrations throughout help draw girls into the book, while lists, quizzes, and stories from real-life girls help readers understand how to embrace risk (and failure), overcome anxieties, and be happy in their own skins. Girls will also enjoy the companion journal which will help them put these skills into practice, as well as Living The Confidence Code, which shares the stories of 30 real girls pursuing their passions.

A Smart Girl's Guide: Money

A Smart Girl's Guide: Money

Money is powerful — but do you know how to manage it well? Learning money skills early — everything from saving skills to savvy shopping to how to value your work time — will benefit a girl for her entire life. A Smart Girl's Guide: Money teaches tweens key money and spending skills, including tips for how to negotiate pay in her first jobs. Full of quizzes, tips, and helpful quotes from real-life girls, this guide will help her feel more confident in her money decisions. This book from the American Girl Library provides a great guide for tweens who are starting to get into more complex money decisions.

Express Yourself

A Teen Girl's Guide to Speaking Up and Being Who You Are

Express Yourself

A Teen Girl's Guide to Speaking Up and Being Who You Are

In an effort to be “likeable” and “nice”, many teen girls feel pressured to avoid speaking their mind or asserting their opinion — they may even fear being labeled “bossy” or “pushy” if they’re too outspoken. This book is designed to help teens remember they have a right to be heard — and find the confidence to speak up! Written in an accessible and friendly tone, with individual chapters tackling common situations like family conflict, digital drama, and romantic relationships, this guide by psychotherapist Emily Roberts draws on techniques from cognitive behavioral therapy to teach your teen how to express her opinion, stand up for herself in any situation, and boost her self-esteem and confidence.

The Young Entrepreneur's Guide to Starting A Business

Turn Your Ideas Into Money!

The Young Entrepreneur's Guide to Starting A Business

Turn Your Ideas Into Money!

Teens can turn their ideas into business that stand the test of time! In this book, author and entrepreneur Steve Mariotti teaches teens why being a business owner can be so satisfying — and how to make sure you create a business that works. From the nuts and bolts of creating a legal structure for your business and writing a business plan, to sales strategies and marketing, and even tips on how to grow you business through hiring, expansion, and IPOs, this book covers everything from a part-time business for a little extra spending money to a company that becomes your career. Along the way, stories of real entrepreneurs provide plenty of inspiration and the reassurance that you can do it too!

Raising Financially Confident Kids

Raising Financially Confident Kids

Financial expert Mary Hunt knows the consequences of poor money management, and now she teaches parents around the world how to raise kids to be savvy, responsible, and confident about their money. A major focus of her book is talking about the pitfalls of marketing and debt, especially in a world where everyone seems to pull out a credit card at the drop of a hat. Individual chapters talk about money matters for different age groups, including preschool, ages six to nine, and ages ten and up. It's a straight-forward and common sense guide to teaching kids confidence with money, even if you're not always confident yourself.

The Opposite of Spoiled

Raising Kids Who Are Grounded, Generous, and Smart About Money

The Opposite of Spoiled

Raising Kids Who Are Grounded, Generous, and Smart About Money

Money conversations can also provide a great opportunity to communicate family values about money and giving. This insightful parenting book shows how families of all income levels can talk with kids about money issues, not only to teach them about financial responsibility, but also to show them how the family's choices allow them to give to their community. Author Ron Lieber explores topics ranging from the Tooth Fairy to birthday parties to college tuition, encouraging parents to foster less materialism and more generosity; his examination of the attitudes we communicate to kids about money will help parents teach that money is a tool, not a goal, and that the reward comes from how you use it.